We’re going to be real with you. The markets have been bumpy. Today, the S&P 500 (measures the top 500 stocks) fell for the fifth day in a row, and both the crypto and stock markets are nearing yearly lows. All the while, we have record-level inflation which is causing prices to skyrocket.

How did all this happen and what should you do next? We’re going to break it down for you.

The Fed steps in

During the pandemic, the Fed stepped forward to stabilize the economy by injecting cash into the markets – a.k.a. printing more money. As a consequence, the Fed’s balance sheethas more than doubled to $8.95 trillion dollars since early-March of 2020. With more cash in the system, the economy held over, consumers had extra cash, and riskier assets like tech stocks and crypto increased in value.

Too much cash can be a bad thing

Yeah, it can be. The U.S. Consumer Price Index (CPI) – which measures the average market basket of consumer goods and services – jumped 8.6% in May, the biggest increase since 1981. Economists give a few reasons for this – 1) global supply chains 2) geopolitical tensions (Russian invasion of Ukraine) 3) the government’s $1.9 trillion Covid stimulus package.

What’s the Fed doing now?

The Fed is focused on shrinking its balance sheet by increasing the cost of borrowing money a.k.a raising interest rates. Fed Chairman Jerome Powell has pointed to more rate hikes in the near future. IRL, this has real life implications, home loans have become more expensive so mortgage demand has fallen to a 22-year low.

And so what does this all mean?

Stocks and crypto have been under pressure as financial markets are taking a hit with both inflation and high interest rates.

Will the markets continue to fall? Will we have an “R” word – recession?

It is very possible. Looking back to 1945, when bear markets occurred, 70% of the time they related to a recession, and the average return during a recession was -30%. And of course, we could all be wrong – the world moves faster than ever.

So what do I do?

Alinea was built for long-term and safe investing and our primary offering, playlists – investment collections ranging from 3 to 3,000 stocks, ETFS or crypto, are built for just that. Investing in playlists allows you to reduce your risk and invest for the long-term. The keyword here is: diversification, which basically means don’t put all your eggs in one basket.

A quick vibe check

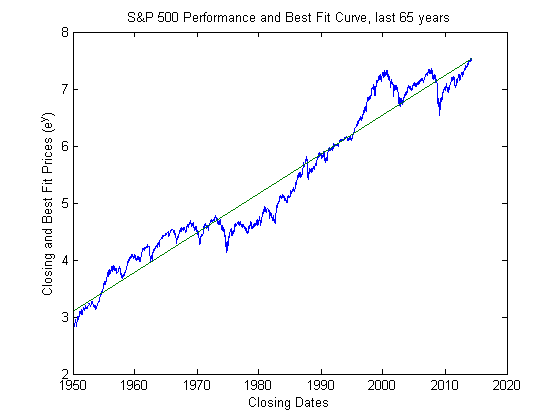

When in doubt, zoom out. The S&P 500 has an average annualized return of 12.3%.

Don’t panic. The legendary investor Warren Buffet said “Be fearful when others are greedy and greedy when others are fearful.” The best investors are the ones who are able to manage their emotions.

Reach out to the Alinea community! We’re here to support you along the way. If you have any questions, you can directly write a question on the app or ping us, slack us, email us, tweet us, or DM us! We’re here for you

(i) Disclaimer

The Content is for informational purposes only, you should not consider any such information or other material as investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation, endorsement, or offer by Alinea Invest or any third party service provider to buy or sell any securities or other financial instruments in this or in any other jurisdiction. When investing your capital is at risk.