…and maybe your investments?

The mantra from so many experts in the investing community is to always diversify. Hedge against inflation (this one is pretty important to pay attention to). Mitigate risk. Did I miss any buzzwords? These catchy phrases and pieces of advice drive retail investors and those trying to build wealth to spread what little cash they have across many assets and places. While massive diversification can help once you’ve really begun to build wealth, diversification can actually make it a longer road to financial independence. I don’t know about you, but I’m not patient. An example of how diversification could have had a negative impact? My personal start in Real Estate Investing.

Building wealth by not diversifying

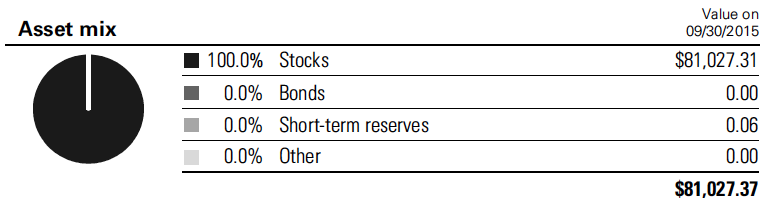

I had finally started to save money from my sales job and wanted to do more than just my retirement account or let savings earn interest. I was fortunate to have earned income that could allow me to buy a home and invest in real estate. At the time I started to explore investing I was split between cash, stocks, and my retirement account but they weren’t really providing too much cash flow. I identified I wanted more ‘passive’ income (anyone who has invested as a land lord knows it’s not exactly passive) and one of the few ways to do that short of starting your own business was real estate that paid you.

I had to make a decision though. I didn’t have the capital to invest in my first properties and keep my stock portfolio. I decided to liquidate and invest in my first two properties from across the country. Keep in mind this took about a year of me analyzing properties and fighting through paralysis by analysis. From 2015 to 2023, almost 50% of my net worth was wrapped in real estate and a lot of my net worth growth was FROM real estate (I’m now sitting at a comfy 22%).

What helped me make the decision

Before making any decisions like liquidating an entire stock portfolio I had to make sure a few things were aligned…

1) Did I know and understand why I was doing this? Yes. I have had a focus on creating cash flow that isn’t my W2 for a long time (well shortly after leaving college in 2011). The investment in property was going to do that at least by running the numbers multiple times over.

2) Are my emotions in check? Yes. Was I looking at this decision based primarily on the numbers and end goal? I was (although it’s tough to entirely remove emotions from the equation). Since I wasn’t going to live in the first properties I was looking at it purely on a cash flow and business perspective. Which property would solve a need by providing a good and safe place to live for a tenant and provide cash flow for the owner (me)?

3) Do the numbers make sense? Yes. If the numbers make sense and so many before me have invested before there was more trust in this decision. Could I have still made a return in the stock market? Sure thing! Could I have made more in real estate with cash flow and appreciation – sure! The numbers made sense to invest and I would have access to more capital through leverage.