And it might be a bumpy ride!

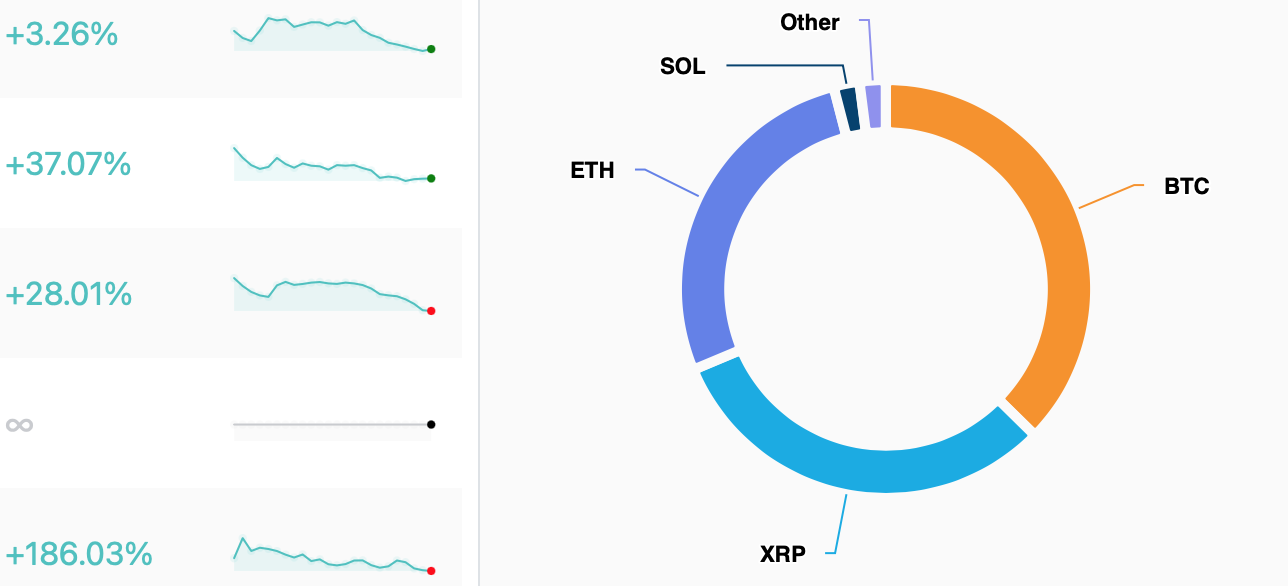

The top for Bitcoin typically comes in around 500ish day after the halving, but we’ve already seen an All Time High well before. This bull cycle is different. Well at least from what the analysts, Bitcoin followers, and now Blackrock all say. This is my first full cryptocurrency bull cycle and I’ve prepped as much as I can. So much has been happening in preparation for this cycle and it only means it’s going to be a little bumpy on the way to the moon! I’m buckled in strapped to the rocket that is crypto and my portfolio.

How is this cycle different?

We’ve talked about it a lot and so has the media. Typically Bitcoin goes through it’s thing naturally (not really since it’s code) cutting the reward to Bitcoin miners in half pushing the price higher. Then at the top profits are taken and alt coins (XRP, ETH, etc.) begin to pump up. Followed by the drop and crypto winter. The cycle takes about 4 years (typically the time it takes to reach each halving). This time we’ve got all kinds of things happening that could change the outcome and the typical cycle might be more of a super cycle…

1) Billions of dollars have flowed into the approved Bitcoin ETFs and essentially forced the general retail investor (and their advisors) into Bitcoin. While I don’t agree with the idea of “it’s too complicated to invest using exchanges,” this can be really positive for the adoption.

2) The ETF approval has started conversations of other ETFs such as an Ethereum ETF meaning more money into the space and for those looking for a price increase that’s great news.

3) Around the halving the big Ripple vs The SEC case is set to go to trial where Ripple has really taken a lot of wins. Notably the first crypto to be legally declared a non-security.

4) The economy is going in the wrong direction (if you take a look at the data). Unemployment is tracking to increase, inflation is holding steady, and interest rates are not dropping. The government also continues to pile on the debt (TRILLIONS of dollars here). With all that people will be looking for places to put their money that can survive the potentially hyper inflation cycle – crypto is one of those.

Why a well laid plan should hold strong

With most investing there is a rule that emotions should be separated from your investing. I’ve been a victim to this and let my emotions get the best of me losing money in the stock market. Although this bull cycle started and will continue to be different (since it STARTED off stronger and differently), my plan to take profit post halving is staying the same and I’m preparing to sell along the way within that 500 day cycle.

I plan on keeping some of my portfolio but at least getting my initial investment out because I believe in what cryptocurrency is trying to solve and what inflation does to us. I’m also of the mindset that I can change the plan slightly if the numbers start getting whacky such as paying off a home to realize more cash flow in a rental.

The hardest part about sticking to a plan in crypto is the volatility can really get to the emotions. I understand why the crypto enthusiast are all about #diamondhands.